Harley Davidson Financial Analysis

Ten years of annual and quarterly financial statements and annual report data for Harley-Davidson HOG.

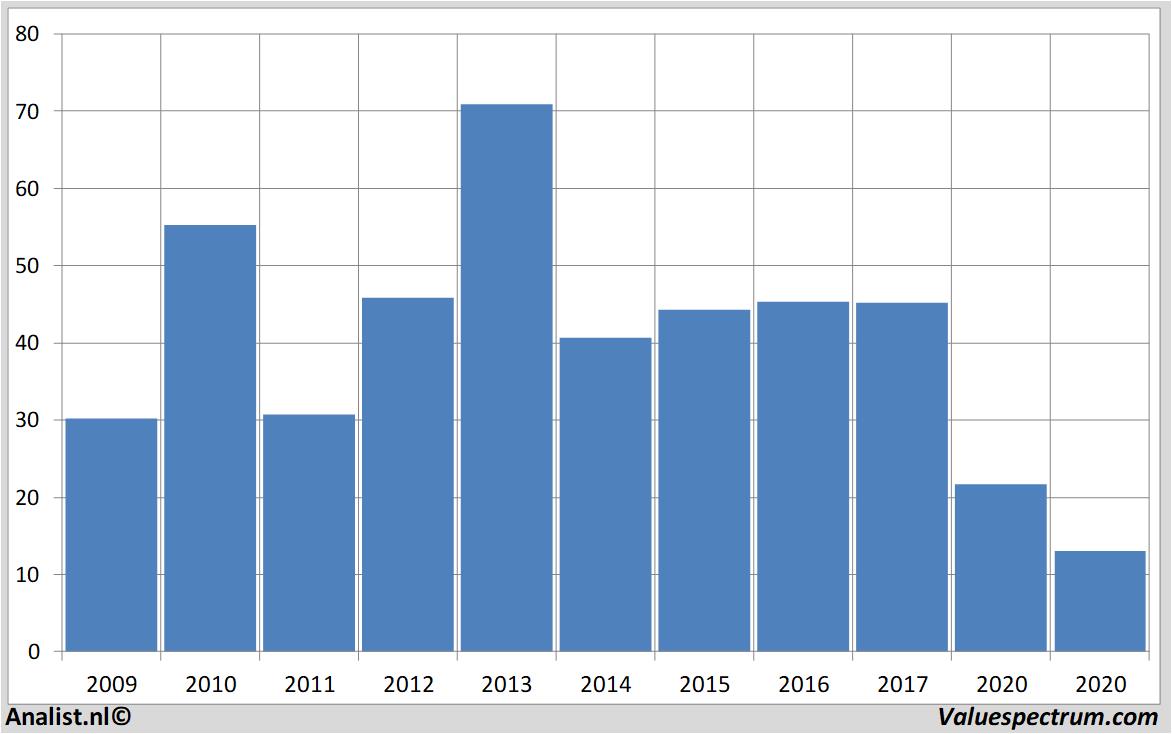

Harley davidson financial analysis. The need to expand globally is fueled by the companys financial situation. It operates in two segments Motorcycles and Related Products and Financial Services. After peaking with 6.

Securities and Exchange Commission SEC. Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc. The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010.

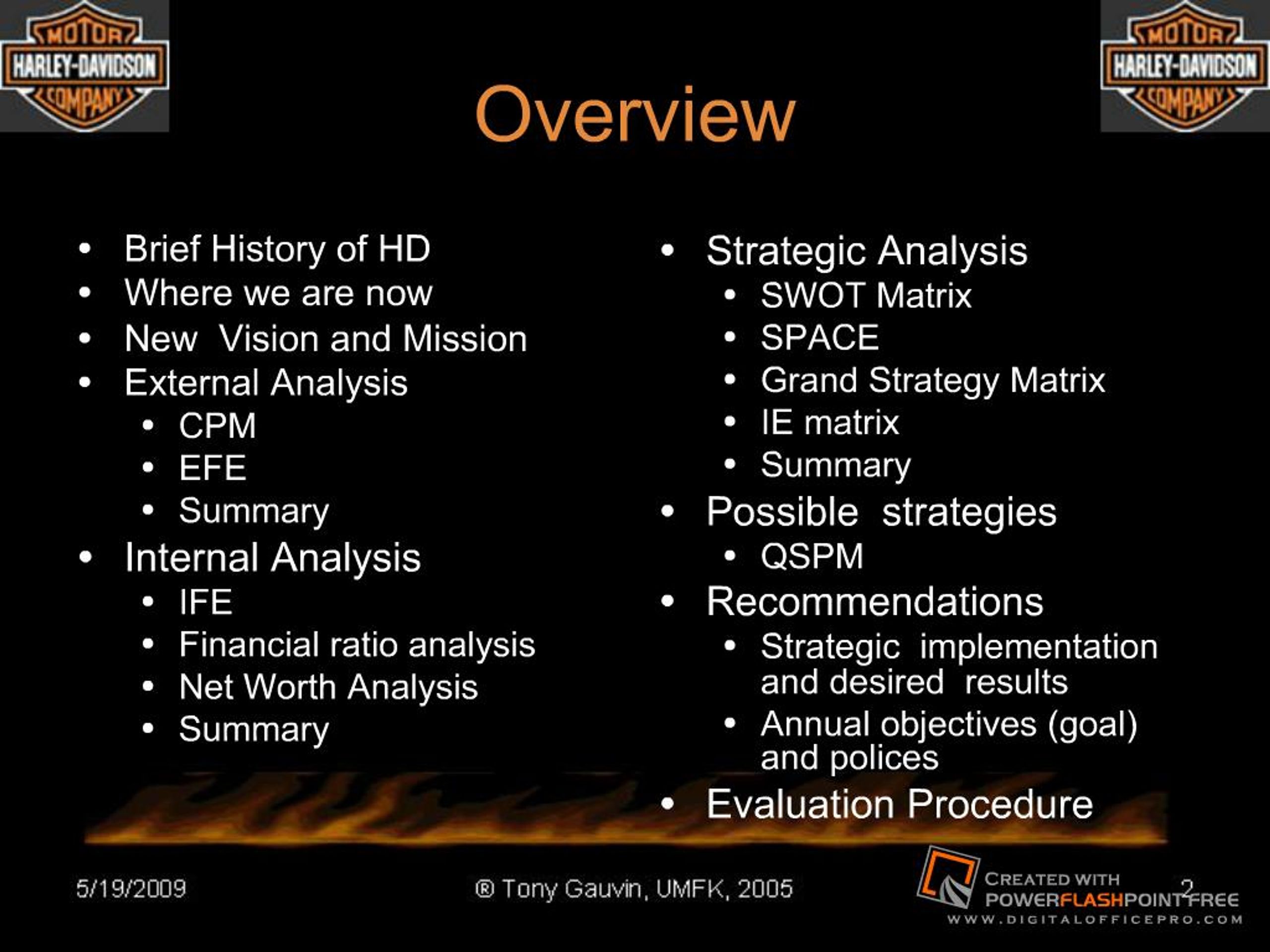

A Strategic Audit Analysis. Harley Davidson Strategic Analysis 1. Hereafter the Company for the year 2020 submitted to the US.

The Motorcycles Related Products segment and Financial Services. We have conducted a comparative analysis of the balance sheet and the income statement of Harley-Davidson Inc. Is lower than its historical 5-year average.

ANALYSIS Harley Davidson Zach Jones 1. The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751. The Investor Relations website contains information about Harley-Davidson USAs business for stockholders potential investors and financial analysts.

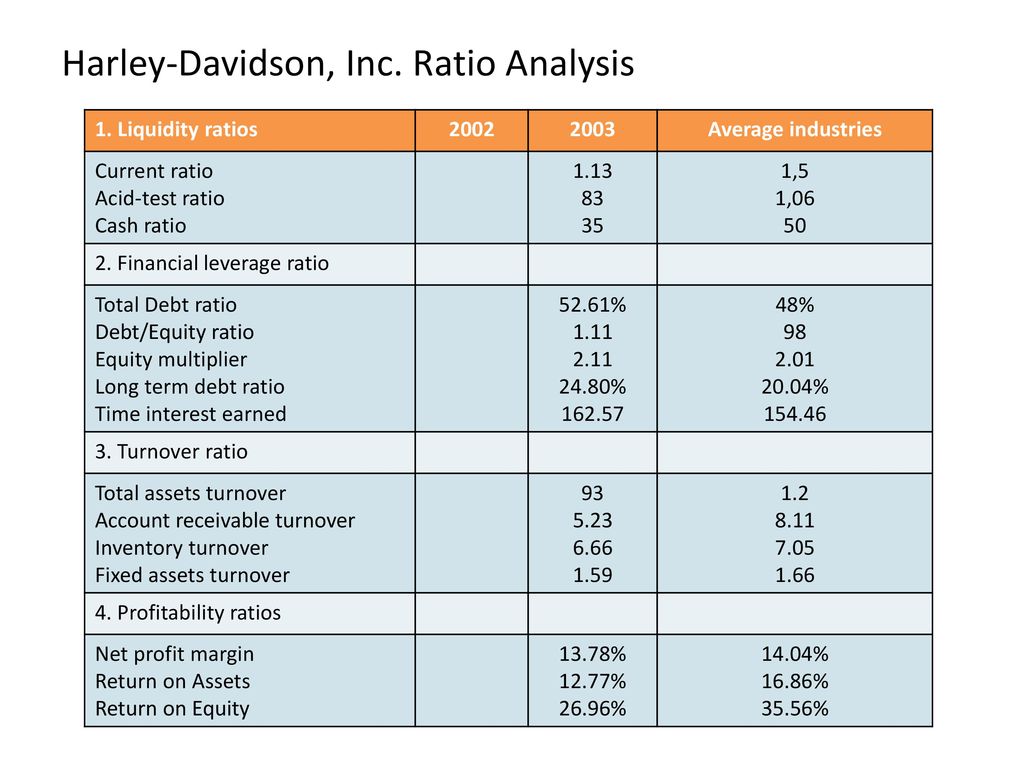

Its consistently high current and acid-test ratios prove that in the short run the company is in a strong position to meet its obligations which would be especially useful in the case of another economic downturn. Developed a Word document entitled The Analysis of H-Ds Current Strategy. Performed a ratio analysis of the financial performance of two competitors and compared them to H-D.